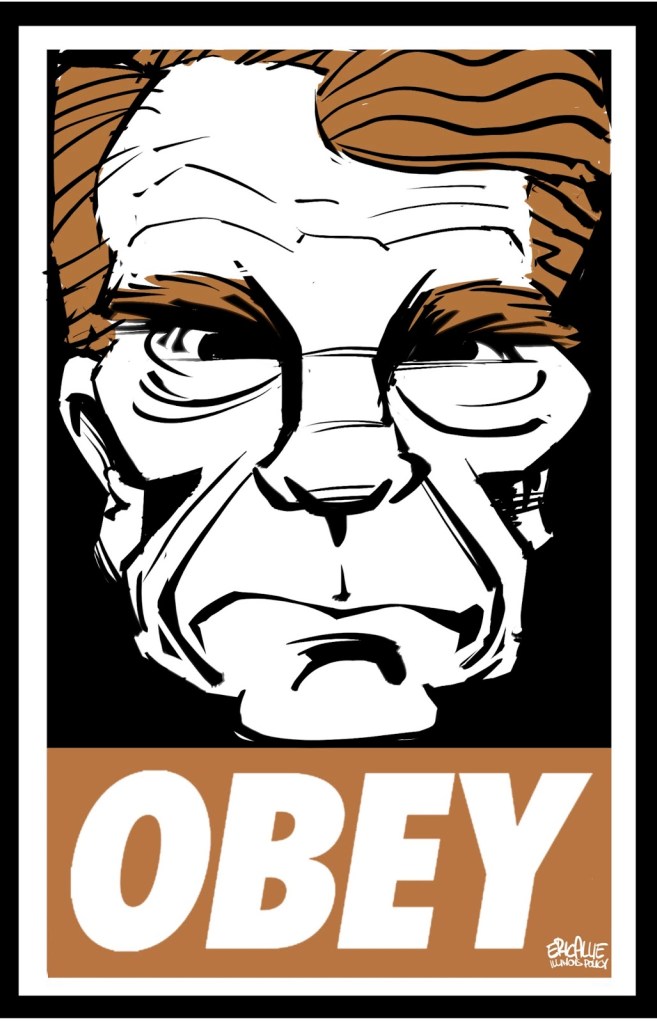

Johnson in photo.

By John Ruberry

If I screw up at work, to the tune of $1,000 or so, I’ll get hollered at by my boss.

And an error of mine that costs my employer $10,000 will see me filing for unemployment benefits the next morning.

Chicago’s newly sworn-in mayor, Brandon Johnson, just made a $10 million whopper of a mistake.

ShotSpotter, which this year changed its name to SoundThnking, is a firm that sells gunfire-detection software, has few friends in Chicago. It is blamed, wrongly in my opinion, for setting up the chain events that led to the death of 13-year-old reputed gang member Adam Toledo in a police shooting. A Northwestern University study found that 86 percent of Chicago police deployments initiated by ShotSpotter alerts led to “dead-end deployments.”

During this year’s mayoral campaign, Johnson vowed to cancel Chicago’s contract with SoundThinking. But earlier this month, a contract with his e-signature approved a $10,184,900 payment to SoundThinking, covering a contract extension approved by his predecessor, Lori Lightfoot, last autumn.

The mayor’s senior advisor, Jason Lee, says Johnson’s e-signature was mistakenly attached to the document authorizing the hefty payment. Of the contract carelessness, Lee said, “That’s not the procedure that we will have moving forward, but that’s what was done.”

The SoundThinking snafu was a two-day story last week in Chicago. Kudos to the Chicago Sun-Times for breaking the story but had Johnson’s moderate opponent in April’s runoff election, Paul Vallas, made a similar mistake, we’d still be hearing about the $10 million e-signature debacle. And of course, the national media, which is a phalanx of the far-left, is completely ignoring this story.

Hunter Clauss, who writes the Rundown, a popular political newsletter on behalf of Chicago’s NPR affiliate, dismissed the $10 million blunder as nothing but “growing pains” for the Johnson administration.

Chicago, because of its massive unfunded public worker pension debt, is essentially bankrupt. Its former cash cow, the North Michigan Avenue retail strip, suffered another departure last week when AT&T announced it was closing its local flagship shop there. Macy’s, Disney, Banana Republic, Verizon, and the Gap have shut down their North Michigan Avenue locations since 2020. The retail strip, also known as the Magnificent Mile, was hit by two rounds of rampant looting and rioting three years ago.

Chicago cannot afford $10 million “growing pains” errors. Don’t forget, ShotSpotter has not served Chicago well as a crime fighting tool.

Prior to his election, Johnson was a Cook County commissioner while also serving as a paid organizer for the Chicago Teachers Union. He was a Chicago Public Schools teacher before being hired by his union.

Vallas was the former CEO of Chicago Public Schools. He was in charge of three other school systems.

Prior to becoming mayor, Johnson was in charge of nothing of importance. Well, he does own a large home on Chicago’s West Side. But Johnson owed over $3,000 in unpaid water bills and fines until he paid up shortly before he was elected this spring. He also recently owed over $1,000 in traffic tickets.

As Barack Obama famously said many years ago, “Elections have consequences.”

John Ruberry regularly blogs five miles north of Chicago at Marathon Pundit.